With the spread of the coronavirus, both the local economy and the global economy have been disrupted. However, unlike during the 2008 financial crisis, banks aren’t foreclosing or seizing assets, this time all banks have announced stimulating measures on their banking products.

The Bank of Thailand’s ( BOT) Governor Veerathai Santiprabhob announced that financial institutions have collectively helped refinance some 30,000 clients, amounting to 234 billion baht in total, after the Bank of Thailand issued a refinancing promotion policy on 28th February 2020, a date where after the coronavirus began to spread exponentially.

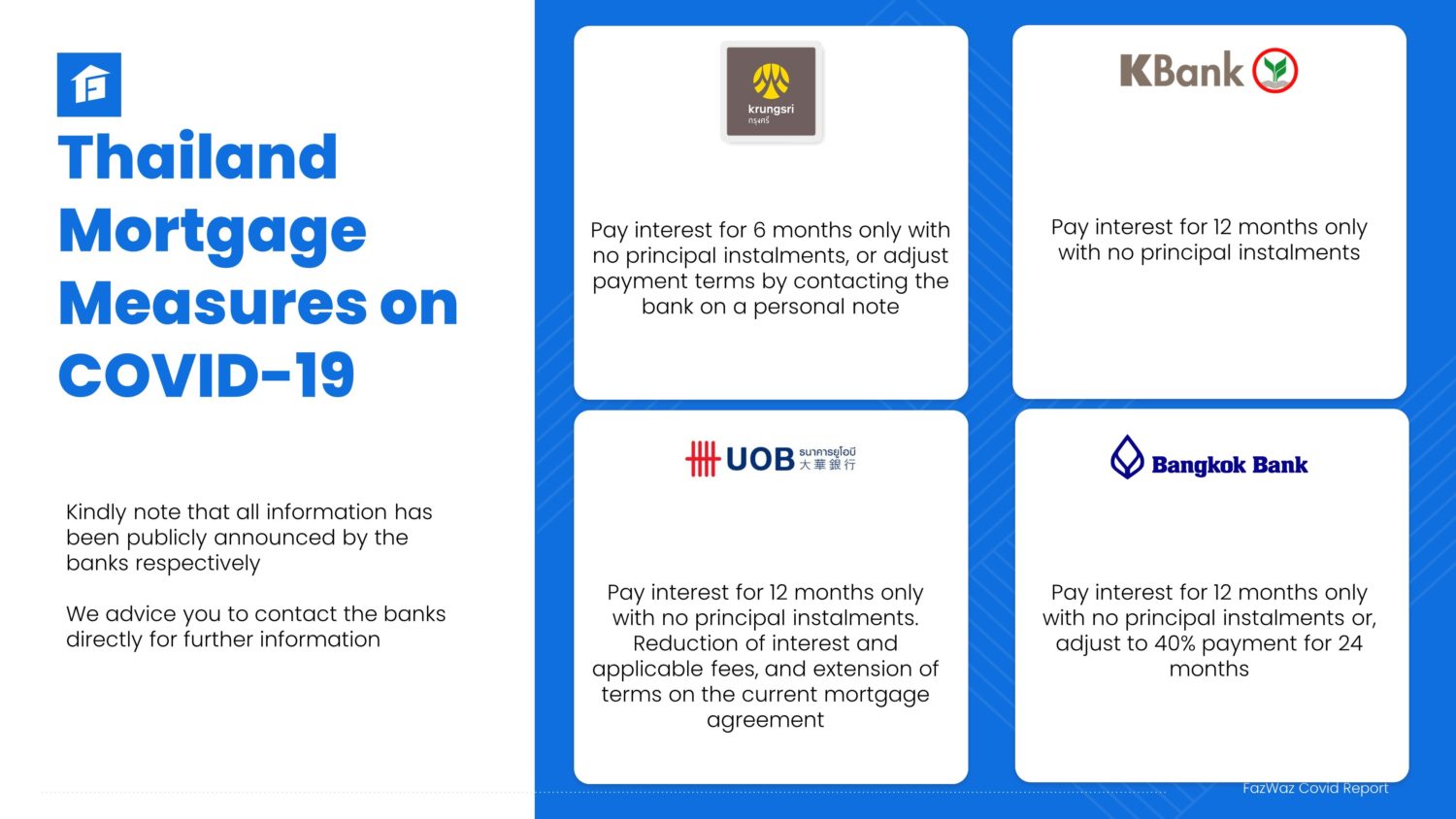

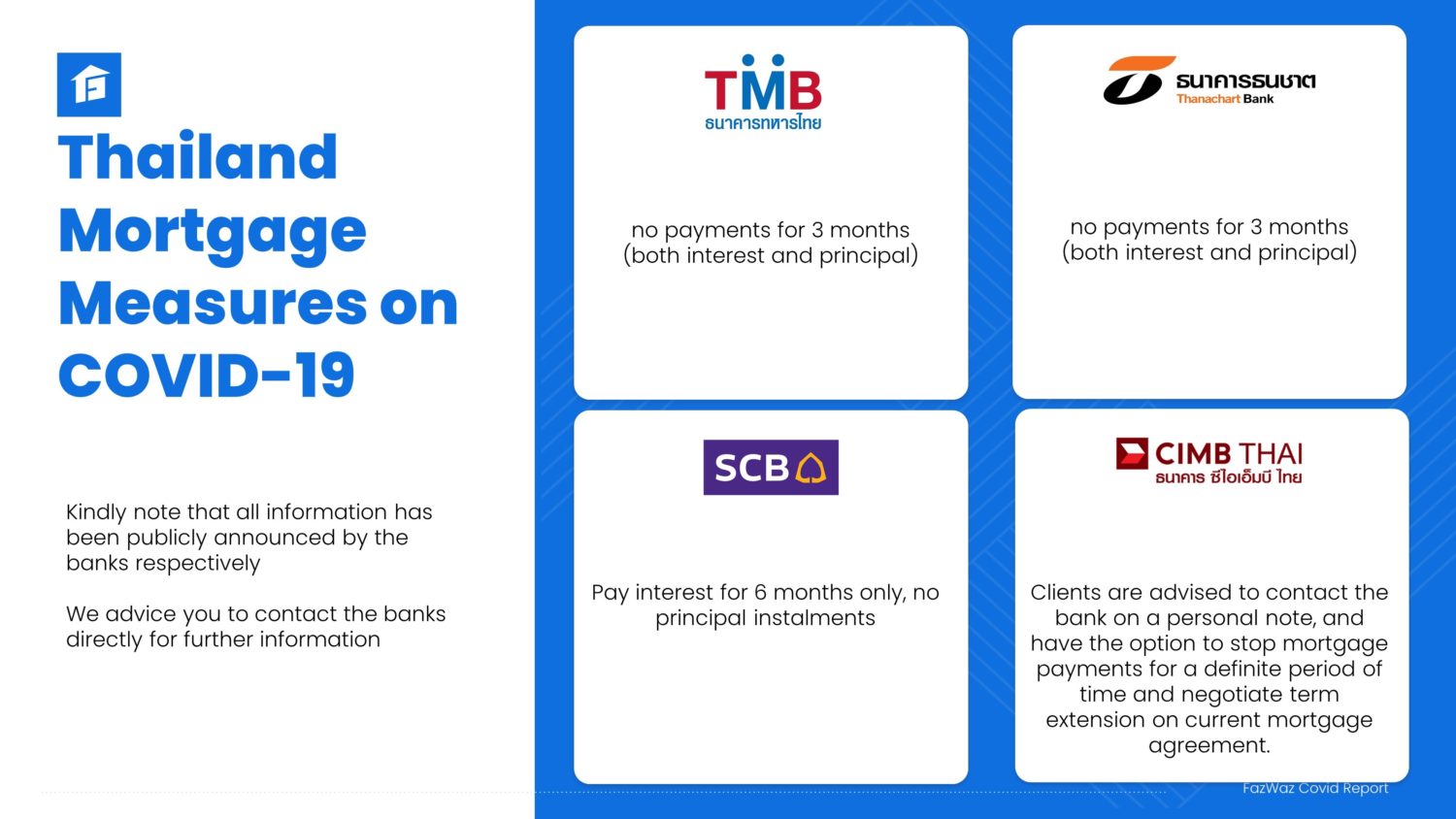

The BOT promotion has been taken seriously by the financial institutions in Thailand and the following measures have been offered:

- A pause in principal payments 6 – 12 months (each bank applies a different term policy)

- Reduce interest rates on mortgage payments

- Extend the mortgage payback period

- Offer negotiations to clients on a case by case basis. Major banks have set up One-Stop Service centers to serve affected clients, and have offered schemes to help different groups of clients.

Furthermore, the Thai Bankers’ Association’s Chairman Predee Daochai said member banks are ready to assist affected clients according to the policy issued in February, by offering a pause in principle payments, reducing the monthly minimum payment amount, and offering soft loans in cooperation with the government. Mortgage repayments are stressful when your job is in jeopardy or, worse when you’ve already been laid off.

Hopefully, the BOT promotion and measures taken by the respective banks will accommodate their clients financial capability. We have contacted the top 12 largest banks in Thailand and asked them to summarize their measures.