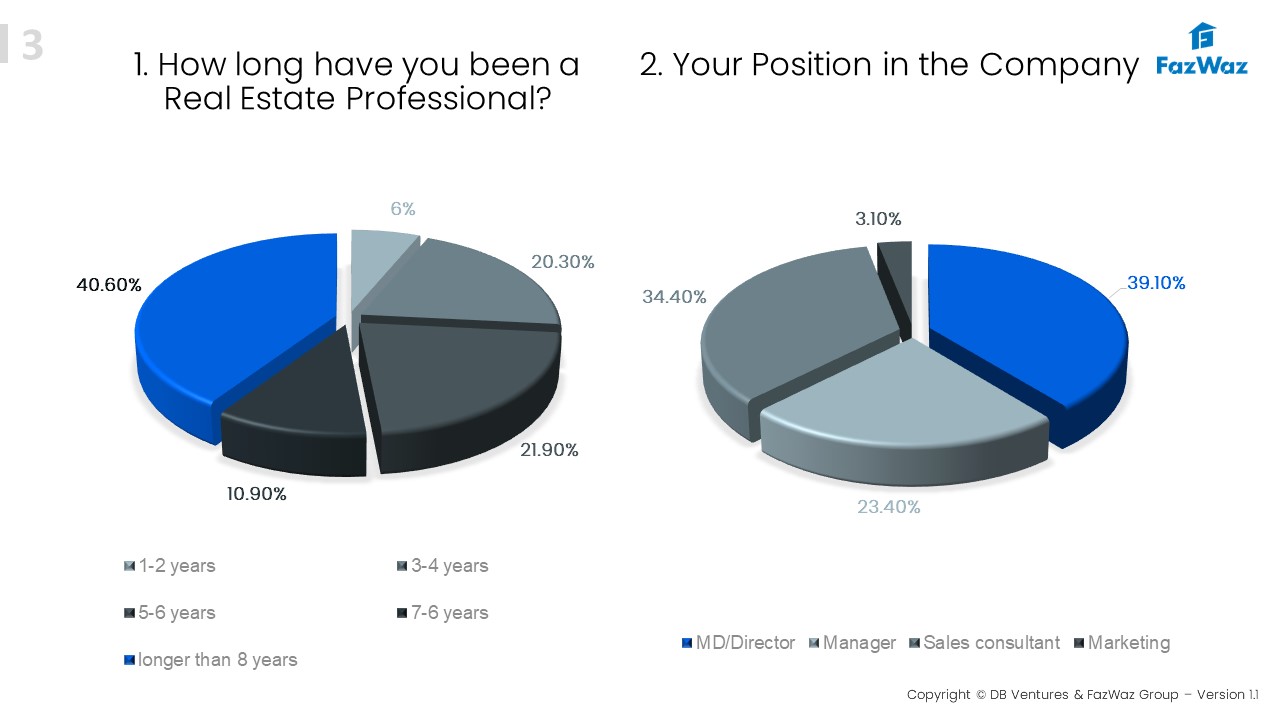

- Over 40% of the real estate agents that responded to the FazWaz Agent Survey have been active in the real estate industry longer than 8 years, and over 60% over the participants are main decision makers within the agency.

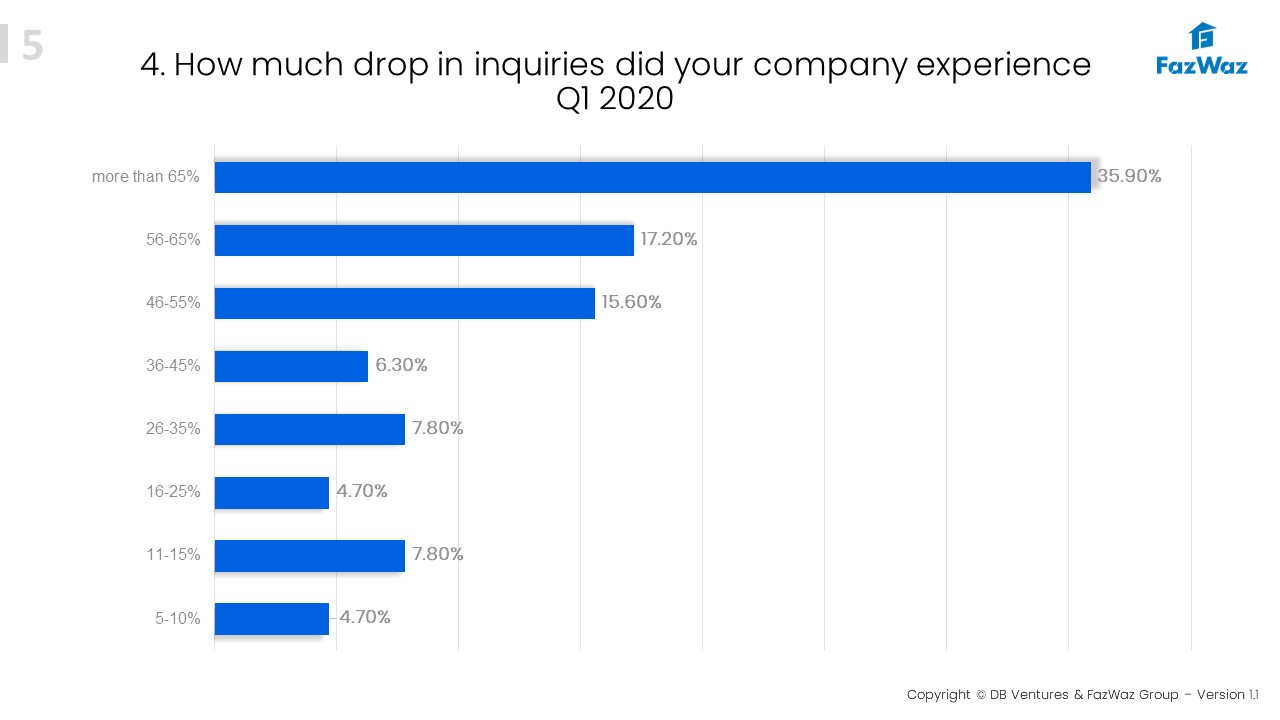

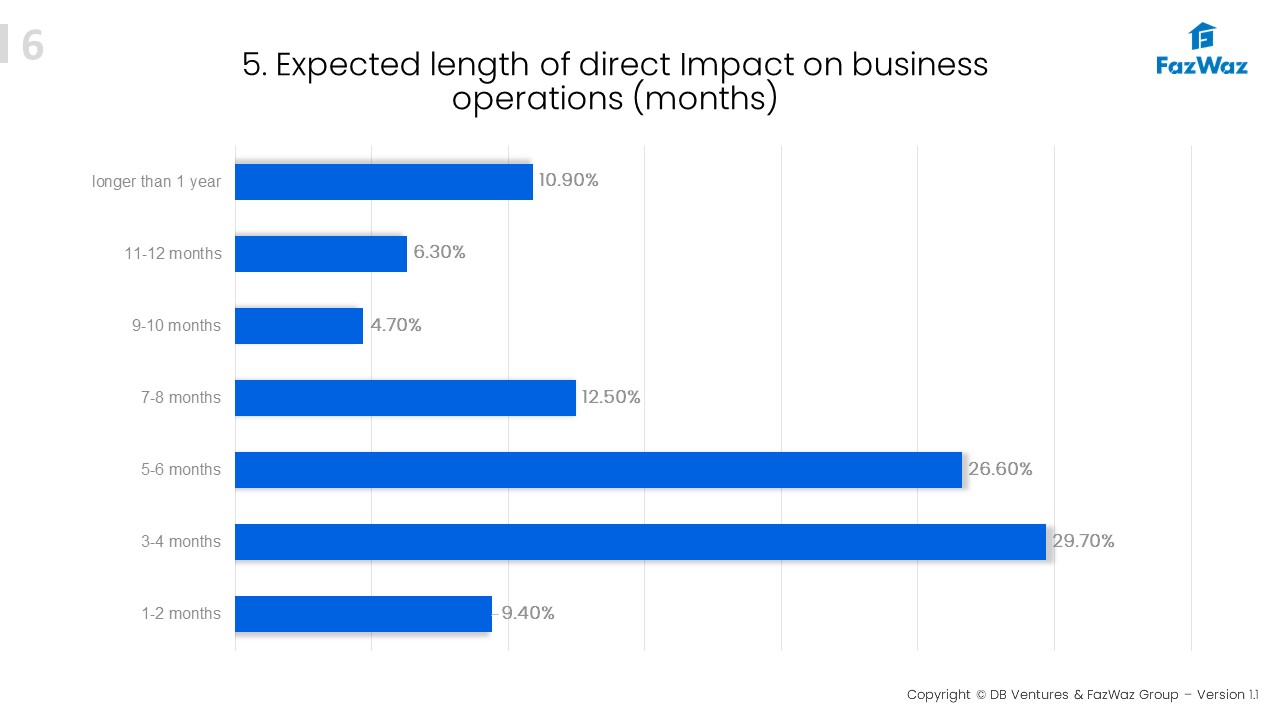

- Unsurprisingly 70% of the agents indicated that their inquiries have dropped more than 50%, with 65% of the agents expect (hope) that the business impact will be limited to 6 months.

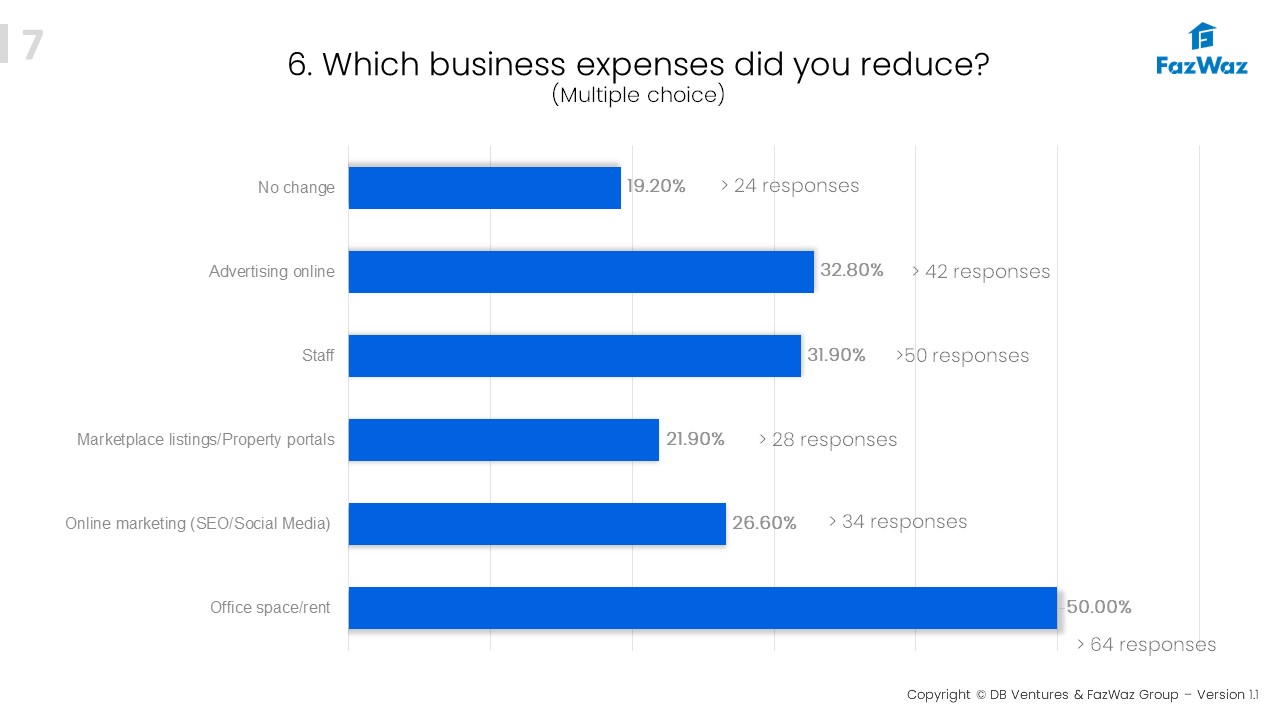

- Fixed cost such a salaries and office space are the two primary expenses that are being reduced by the agents, secondary and quite rightly, are the marketing expenses.

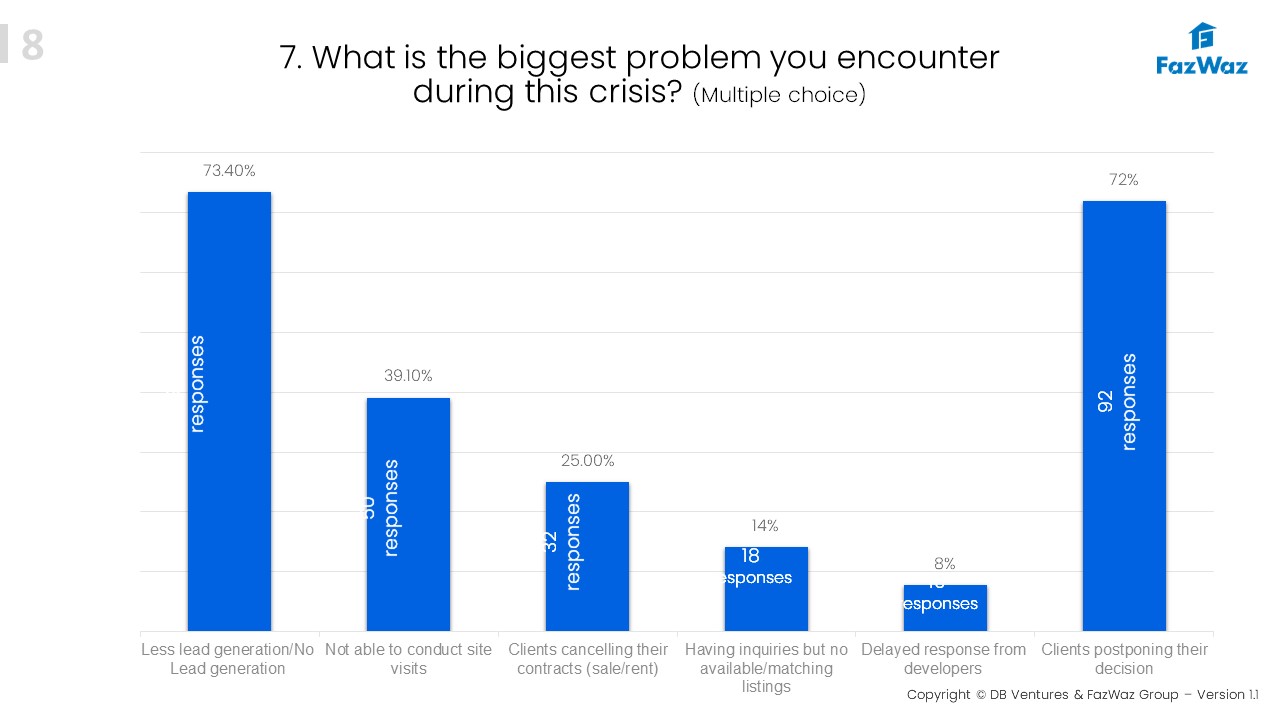

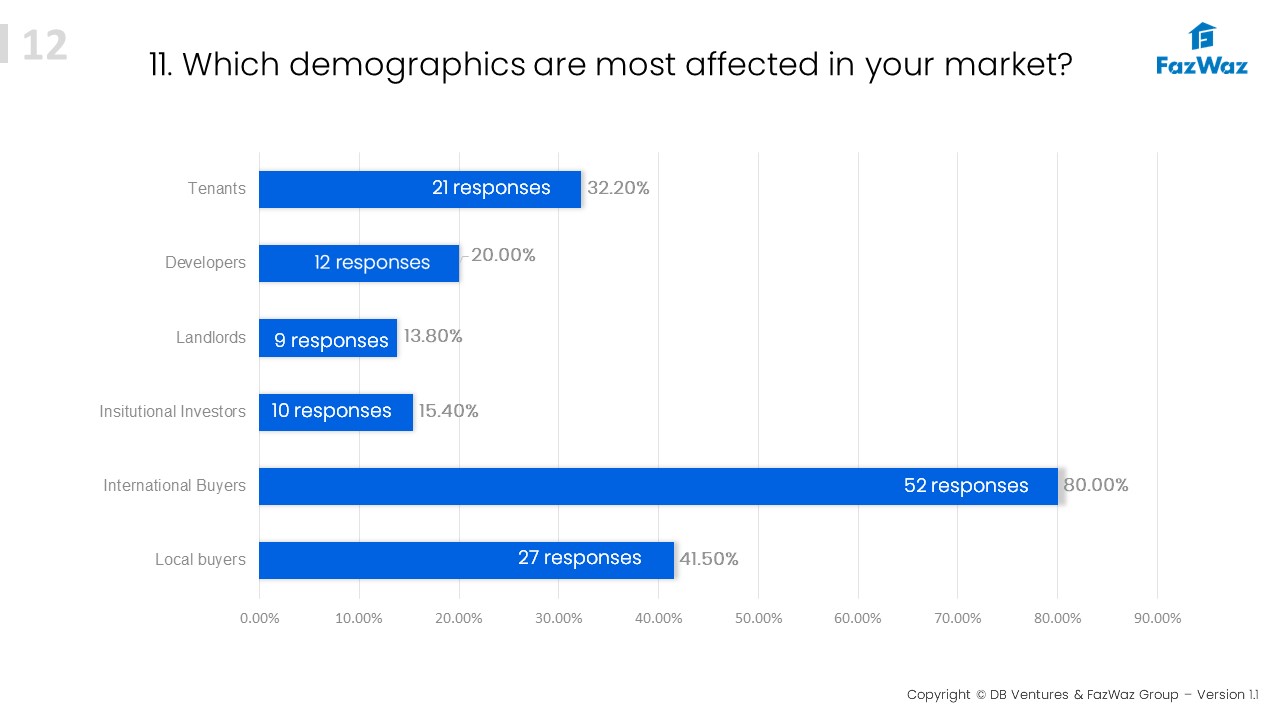

- Over 70% of the agents share the same problems: the drop in inquiries (lead generation) and clients postponing their decision – potentially due to travel restrictions and also a “wait and see” mentality by buyers and investors until the market settles.

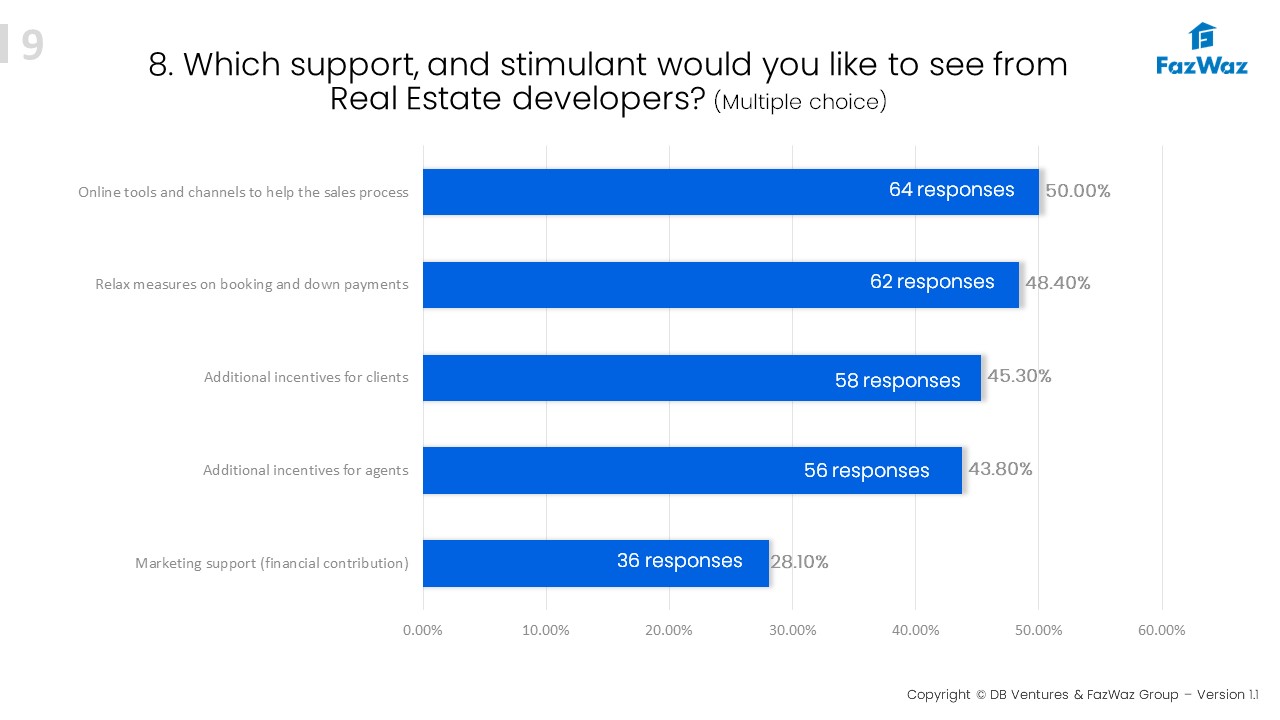

- Raising commissions by sellers and developers does not incentivize agents anymore. Over 50% of the agents require more online tools, relaxed buying measures for clients such as flexible payment terms or waiving of maintenance and free transfers as their incentives to convert home buyers during this time.

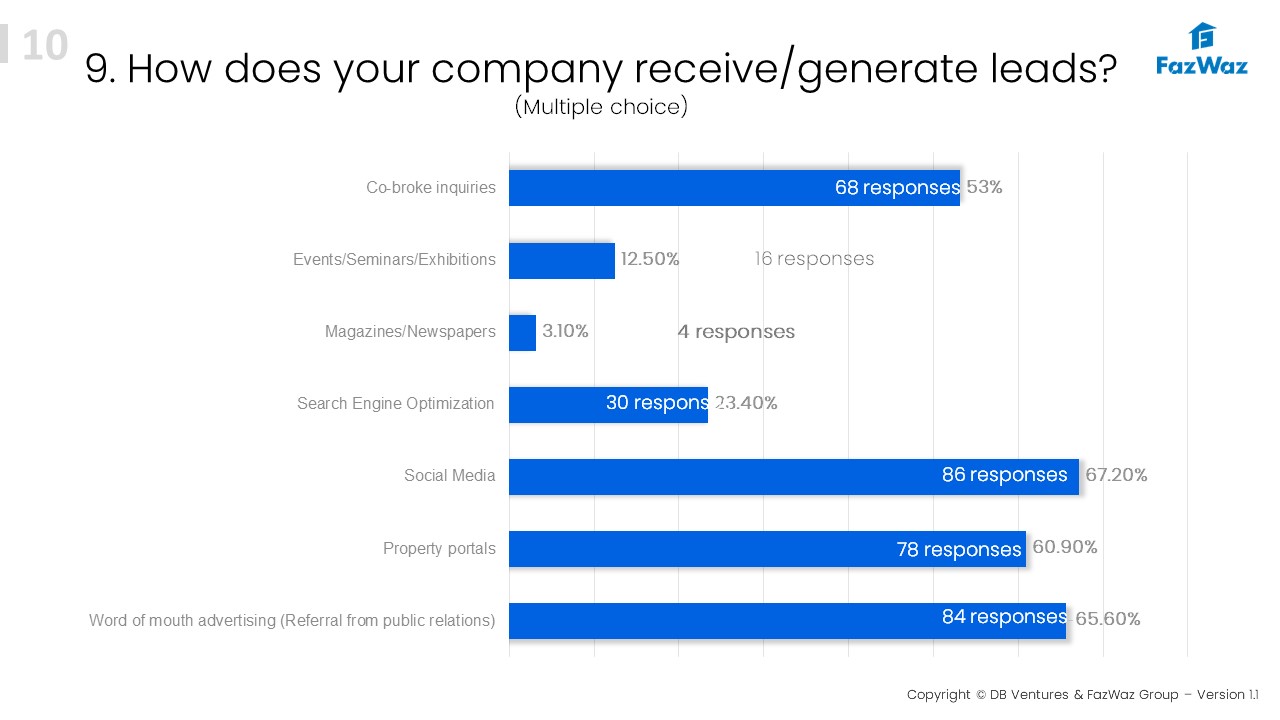

- 65% of all agents receiving new client inquiries are by word of mouth advertising, property portals and social media. Over 50% of the agents utilize and work with co-brokers but indicate that this only work within their smaller trusted circles.

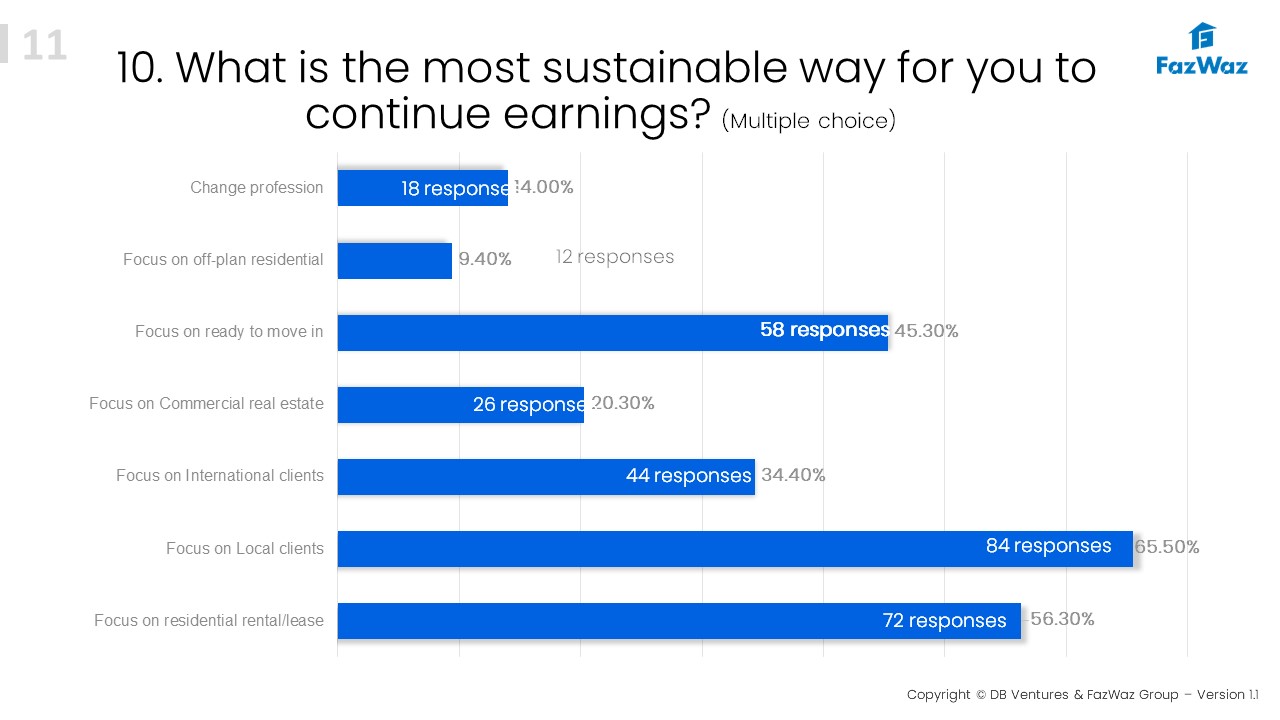

- 50% of the agents find that ready to move in and/or rental deals are currently the most sustainable way to earn. Less than 10% focus on off plan residential sales segment. This is an interesting fact knowing that there is a significant supply of off plan developments in the Thai market.

- The general sentiment is a focus on local clients, is 50% higher than the focus on international or overseas clients. This is a figure also seen at the developer survey.

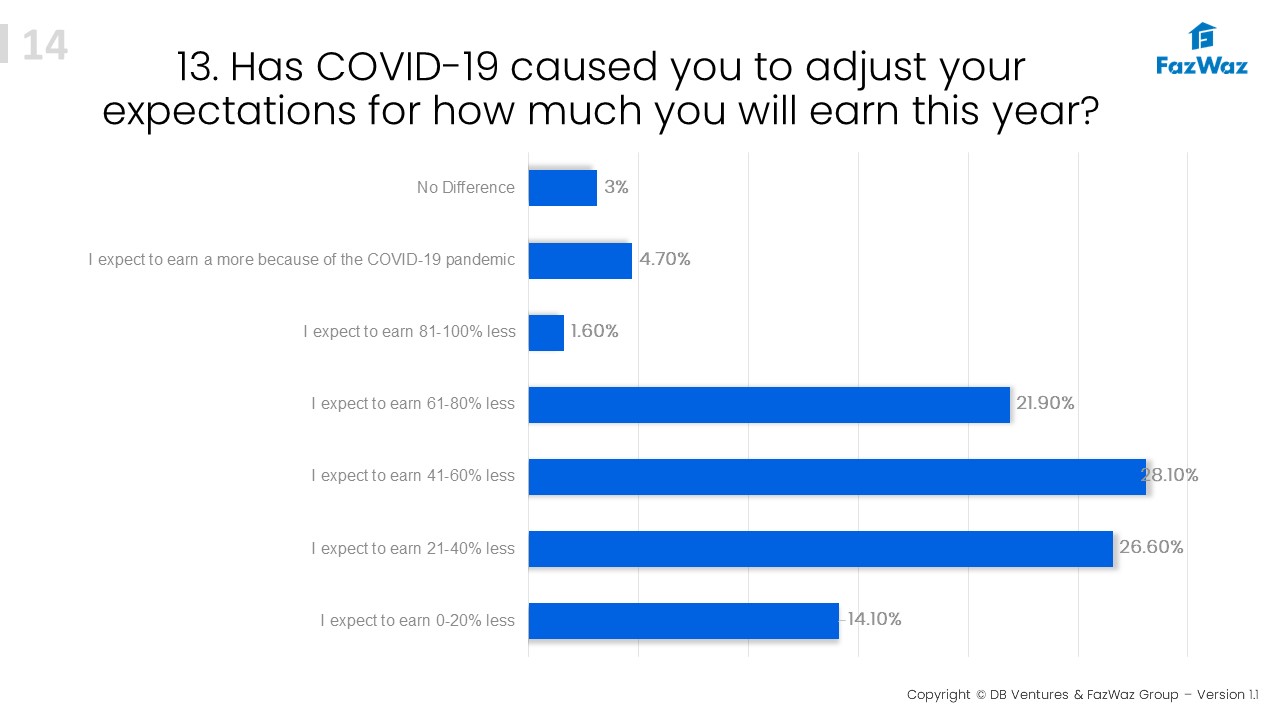

- On average 53% of the agents expect that their earnings will be 50% less due to the COVID crises.

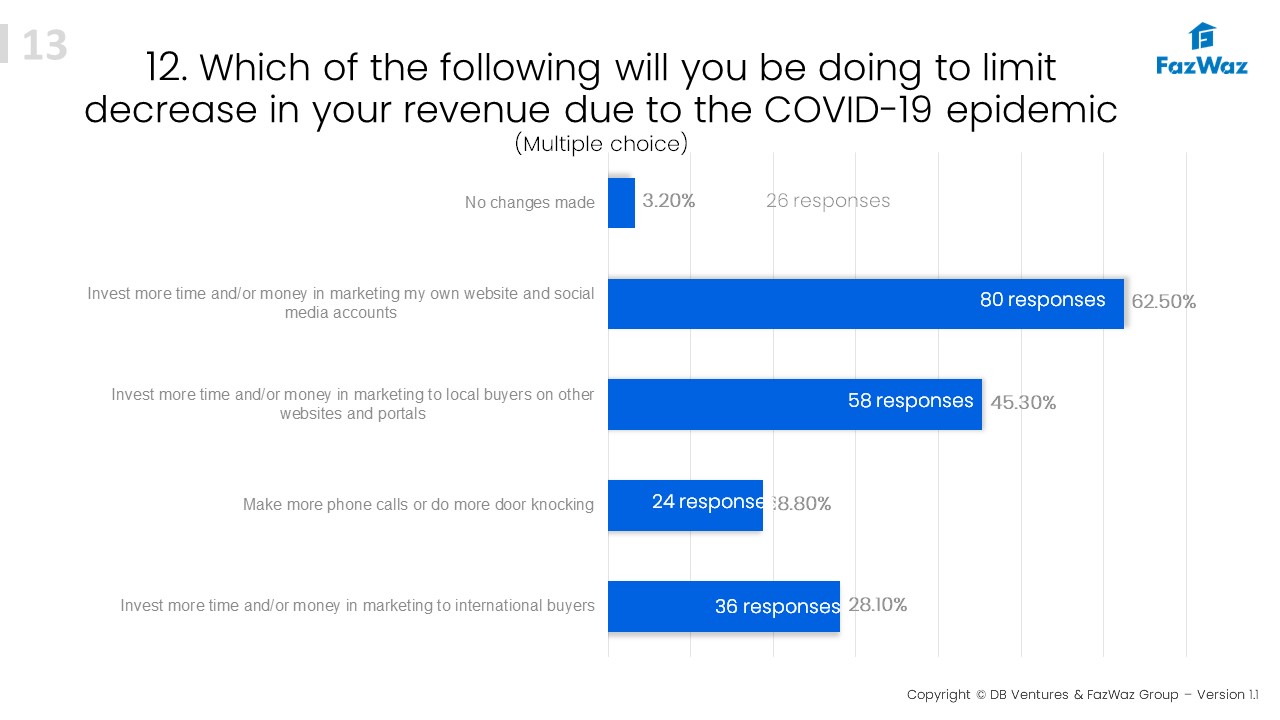

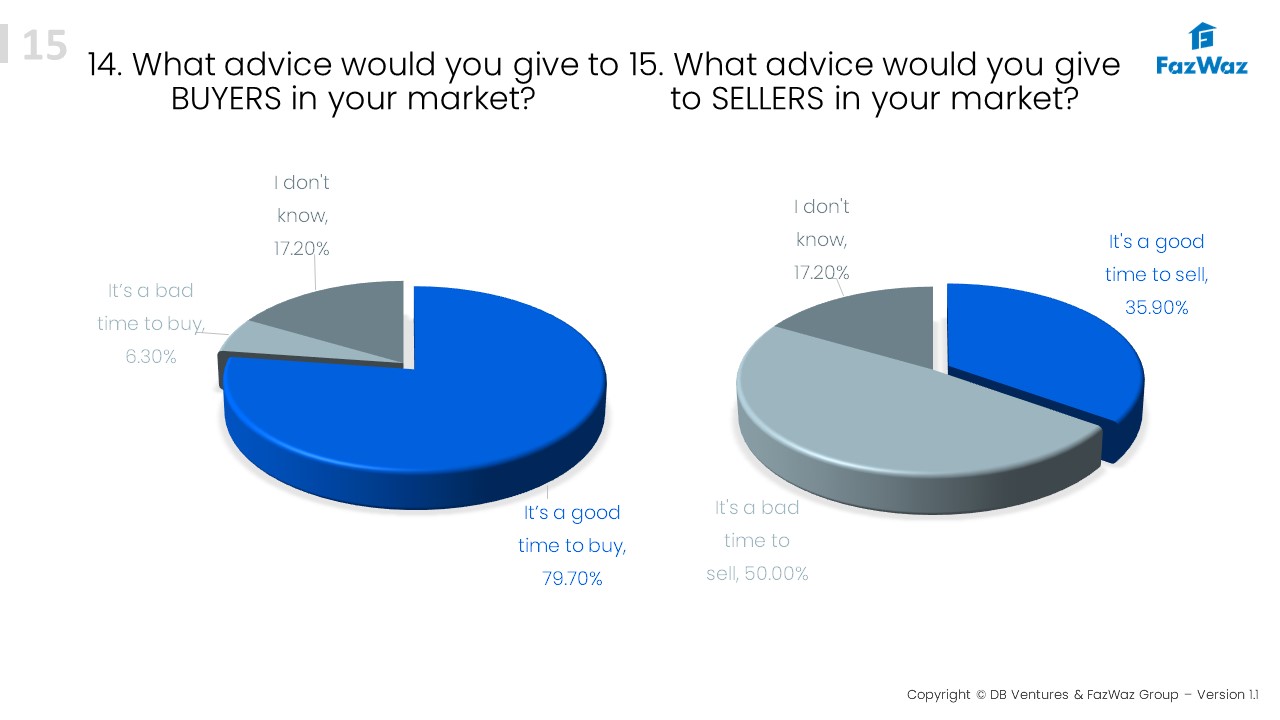

- To counter their loss, over 60% of the agents will place more time and money on their websites and social media accounts. Again emphasizing on local buyers. 80% of the agents would advise that it’s a buyers market. 35% of the agents will advice it’s a sellers market

- Overall shared agent sentiment indicates that developers should reduce/stop new project launches and focus on unsold units. Speed up commission payments, and would like to see improvement in communication of establishing contact with developers